The surprising power of a low-income year

The surprising power of a low-income year

by Caitlyn Driehorst

Published: June 27, 2025

There’s many reasons why talented, successful people may have a low-income year: perhaps you were laid off. Maybe your new business is still getting off the ground. You could be taking time off to care for a loved one, or in graduate school, or even on sabbatical.

But whether this is “change you chose, or change that chose you,” losing a regular paycheck can be disorienting not only for your budget, but also for your sense of agency. You may think this is a time to be protective of your money, and not a time for proactive moves.

However, as financial planners, we actually get excited when someone has a lower-income year. In fact, some of the financial strategies are so strong, that intentionally planning a low-income year can be worth it for some people (assuming it’s consistent with other goals.)

This power comes from three main sources:

You’re in a lower tax bracket for income taxes and for capital gains, opening up some specific investing opportunities

You’re eligible for certain income-qualified tax credits and programs

You have the time to knock out personal admin — critical in a part of your life where procrastination can be expensive

Before we jump in…

Register for our upcoming webinar, “The Power of a Low Income Year”

We are bringing back this webinar, with fresh updates based on audience feedback (thank you!!)

We’ll cover all three of the sources of low-income year power in-depth in this presentation, as well as strategies to minimize potential harm during a year when cash is tight. (For example, if you do end up needing to jailbreak money out of a retirement account, withdrawals from some types of accounts will have fewer penalties / taxes than withdrawals from others.)

All of our webinars feature BCG-alum slide decks, helpful PDF handouts, and recordings sent to you via email after the session.

Register to join our session on Tuesday, July 15, 2025, at 9:00 Pacific / 12:00 noon Eastern.

The first source of power

Investing opportunities associated with lower tax brackets

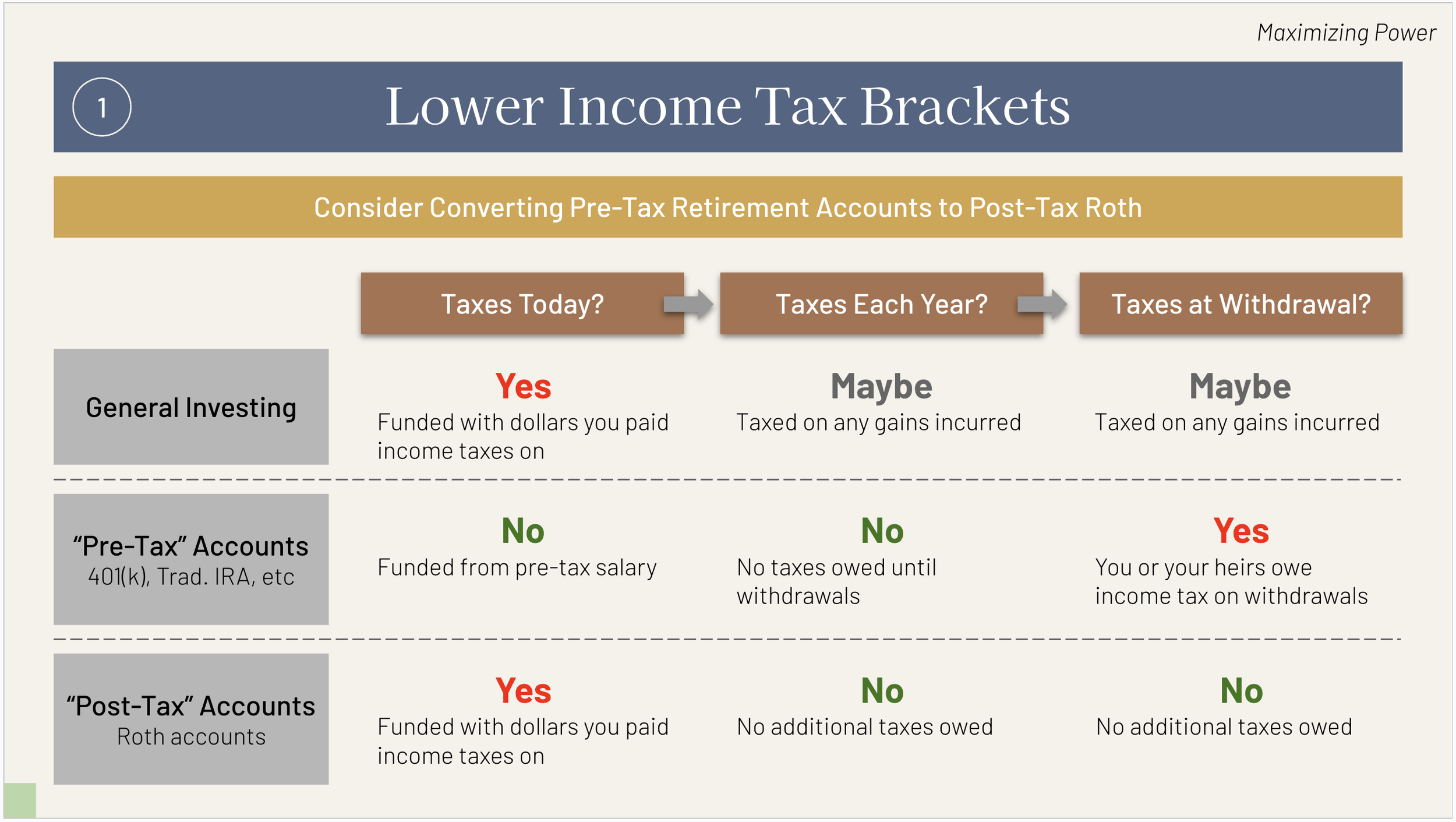

Roth conversions: If you have old 401(k)s, a low-income year can be a great time to lock in today’s lower tax rate forever by converting those funds to a Roth IRA. We’ve written before about Roth conversions here, and we go deeper on this topic in our webinar.

Capital gains harvesting: While tax loss harvesting is written about more commonly (and something we love for our clients via our Betterment for Advisors platform), in a low income year, you may be able to realize up to ~$95,000 in long-term capital gains without owing a nickel of taxes. (If you used to work for a tech company and have unsold RSU / ESPP stock, this may be especially interesting for you!)

One reason I love this webinar? We don’t just tell you what these opportunities are; we explain how income taxes and capital gains taxes work in the first place, so you have your feet under you when you try to understand these more advanced moves.

We walk through how different types of investing accounts are taxed — and why understanding your earning in a particular year can help you choose the account type that best-matches your current circumstance.

The second source of power

Opportunities you may only qualify for when your income is lower

“Backdoor Roth” must be the coolest name in personal finance; it’s the ship that’s launched a thousand Instagram content creators. But if you’re in a low-income year, you don’t need a backdoor; you can go straight in the front door and contribute to a Roth IRA, locking in your low income tax rate today and never owe taxes again on those dollars, assuming you withdraw in retirement.

We have a PDF downloadable list of income-qualified opportunities, including a credit against health insurance premiums for plans purchased on the public marketplace, which we share with webinar attendees. Join our session to hear the full list and to learn why some of these are especially attractive.

The third source of power

Time to knock out personal admin

Waiting to hear from job applications can be agonizing. Put your nervous energy to use by taking this time to get your affairs in order. Old 401(k) accounts hanging out, where you may forget them some day between now and 2045? Subscriptions you never cancelled? And have you updated your account beneficiaries on your banking accounts? Now can be the time!

Shame and anxiety can make checking your financial accounts more difficult during unexpected unemployment than it may be in another time when you feel greater confidence in your financial picture. Assert your agency by investing in the good organization that recognizes what you have achieved.

In our webinar, we’ll walk through our top recommendations for organization moves, and provide a downloadable PDF handout with a complete list.

One example of personal admin well-suited to time between roles? Updating your financial accounts’ account beneficiary designations. Have you had children? Did your sister change her name? Is there a charitable cause you want to honor after you pass? These designations can dramatically reduce the admin associated with your loss, should anything happen to you, and ensure that your wishes are honored.

Should you hire a financial advisor in a low-income year?

It’s one of the most cliche squabbles for a couple: one person hires a housecleaner, the other person busily sets to work cleaning the house before the cleaner arrives. I’m the latter in our relationship:

“Jonathan, you don’t understand, what will the cleaners think if they see our kitchen so messy?”

“… they’ll think that’s why they’re here?”

At RightWise, we often talk to prospects who want to hire a financial advisor to help them out with their big strategic questions – but only after they’ve figured everything out first and done “the easy stuff” on their own. But then, life is busy, they get stuck on a question (for example, dividend treatments for rollovers?), and they end up feeling bad, nothing is done, financial chores remain unfixed – and we miss out on an awesome new client.

If you’re between roles, this could actually be a great time to hire a financial advisor:

Knock out all the admin and chores associated with a new plan, including optimizing your existing investments

Understand your current runway and how any missed savings may affect your financial goals — or feel confident that you’re within safety

Negotiate a new compensation package and understand the benefits of a new role – especially if there’s any stock compensation, we love helping you wring all the possible value from these programs.

There’s absolutely such a thing as too much financial ambiguity whereby we may not be able to add value; in that case, we’ll let you know and hope you return to us when things are settled. It’s against our fiduciary duty to accept a client we don’t believe we can serve.

But for many people, a time between roles is a great time to develop a relationship with a trusted advisor, to do the hard thinking to define future financial goals – and to knock out all the chores associated with that transformation.

Learn more about how a low-income year can push your finances forward.

Join us for the next session of our webinar, “The Power of a Low-Income Year.” We’ve taken care to prepare a technical and useful presentation to help you find agency in a time that can feel disorienting.

"Before I founded RightWise, I spent a decade in corporate strategy, writing decks for CEOs and senior leaders of gigantic companies. Today, I take that same care in creating informative, lively materials for you to take action on your own financial life. If you give us 50 minutes of your time, I want you to get as much value as possible from that exchange.”

- Caitlyn Driehorst, financial advisor

We are not attorneys and this article is intended to be educational and informative, not legal advice. As we like to say, “This is where your research should begin, not end.”

Author: Caitlyn Driehorst , Chris Casale , Hannah Farrow

Date Published: 6/9/2025