401(k)s for Aspiring Émigrés: How to think about retirement when you’re not sure where that may be

by Caitlyn Driehorst and the RightWise team

Caitlyn Driehorst is a financial advisor at RightWise Wealth, as well as the firm's founder and CEO. Caitlyn began her career at the Boston Consulting Group and held strategy roles at MGM Resorts, Capital Group American Funds and two venture-backed wealth startups. She holds a B.A. from the University of Chicago and an M.B.A. from UC Berkeley's Haas School of Business.

Published: October 15, 2025

Hannah, Chris and I meet every Monday morning to discuss our trickiest client situations together as a team, and we come back frequently to the cliche, “we believe in planning, not a plan.”

Our clients have so much uncertainty: will they have another child? Two more children? Will they stay in tech forever, or move to a small town in the Carolina foothills to open a charming bookshop / coffee shop?

One common uncertainty: whether they will retire in the U.S. or overseas. Many clients have family abroad, whether that’s in Europe or Asia, and aren’t sure if they may want to move back to be close to relatives and perhaps enjoy better cost-of-living or different political atmosphere – or, if they will discover that “home” has changed as much as they have over the decades, and that the community they’ve built is the one they want to keep. Other clients dream of the adventure of life overseas, or worry about their safety in the U.S. as members of a minority group.

But “long-term uncertainty” butts its head against the immediate, powerful choices you need to make today, especially around 401(k) contributions. Our clients are commonly in their highest-earning years, and the powerful tax savings of 401(k) and its low-cost investing options have significant value.

So, what should you do? And perhaps more importantly – how should you think about these choices?

Note that we are not “cross-border planners,” and we don’t have the licenses or expertise to provide specific advice on investing outside the U.S. As we say at the top of every webinar, “this is where your thinking should start, not end.”

Context: How do 401(k)s work?

When you contribute to a 401(k), that amount is pulled off of your income that is taxed today. So if you would be taxed on $220,000 of income, but you contribute $20,000 to your 401(k), then you’ll be taxed on $200,000 of income rather than $220,000.

And, if that $20,000 grows to $25,000 later in the year, you’ll owe no taxes on that increase when next April rolls around. 401(k)s are all about no taxes today, and you may already know this part, since you’ve seen it in action.

Curious to understand more about how income taxes, 401(k)s and Roth accounts work? Register for our webinar, “Personal Finance 102,” for a detailed walkthrough from a RightWise financial advisor.

But the second part of the equation, many people don’t learn until they’re in or near retirement:

You’ll owe income taxes on any money you withdraw from your 401(k) in retirement: Let’s say you’re retired and you go to take out $10,000 of your 401(k) to support living expenses. “Awesome,” says the government. “You paid no taxes when you saved this money. Hope that was fun for you. Now, pay me taxes.”

You’ll be required to take some distributions (so that you pay some taxes), probably starting at age 75: “Ah ha!” you may think. “Caitlyn, what if I just never pull out that money? Will I never owe taxes?” The government got there first: to make sure you do eventually pay taxes, they will require that you start to withdraw money from these accounts at some point – and even that your heirs will be required to make withdrawals, if you die and pass along the account. These are called “Required Minimum Distributions” and if you are working with a financial advisor in retirement, they’ll be a big part of your planning.

If your tax rate was the same your whole life, there would be no ultimate difference in the take-home from a pre-tax account (like a 401(k)) or from a post-tax account (like a Roth IRA.)

Reference: Henry-Moreland, Ben. (2024, September 25). Why pre‑tax retirement contributions are better than Roth in peak earning years (even if tax rates increase). Kitces.com. “Tax Rates the Same” chart.

However, it’s much more likely that your tax rate will vary widely over your lifetime. For our clients, we typically see that today, their income is at or near lifetime highs, their tax rate is at or near lifetime highs, and so they should punt these taxes to retirement when they won’t be working, will have lower income, and therefore, a lower tax rate.

Your boring ol’ 401(k) has some pretty amazing benefits

While your future may be uncertain, what is certain: if you are a high-earner (and especially if you live in a high-tax state), your 401(k) can have tremendous value, relative to investing in a taxable brokerage account.

401(k) reduces your taxable income today, especially valuable in your top-earning years

An example: Jason and Jessica are married and live in California. Together, they earn $450,000 per year in salary, and Jessica’s RSUs vest at $100,000 over the course of the year. With a total income of $550,000, their federal bracket is 35.0% and their California bucket is 9.3%, for a total tax rate of 44.3% on each next dollar they earn.

If Jason and Jessica both max out their 401(k), they will reduce their total taxable income by $47,000, avoiding ~$20,800 of income taxes this year.

Now, will they owe taxes on that money in retirement? Sure. But it’s unlikely that in retirement, they will have income so significant that it pushes them into a 44.3% marginal bracket – even if they are in a high-tax European country.

Your employer match is “free money”

Employers will commonly match 401(k) contributions. If you contribute anything less than their voluntary match, you’re leaving dollars on the table. Why work for less than someone is willing to pay you?

Tax deferment accelerates the benefit of compounding

We love the flexibility and “any-time access” of a liquid taxable brokerage general investing account. However, even if you’re not taking withdrawals from a general investing account, you can end up owing taxes along the way: funds will pay out dividends, or you may need to effect some sales for rebalancing. While tax loss harvesting can mitigate this drag in some circumstances, the loss of early dollars can have an exaggerated impact due to compounding over a multi-decade horizon.

Within a tax-protected account, however, your dollars incur no such intermediate taxes: you can receive dividends with no taxes and rebalance fearlessly. With decades to compound, these little choices can add up big.

Comparatively high maximum contribution

An HSA is a beautiful tax-advantaged account, but the most you can contribute is $8,500. Traditional IRAs and Roth IRAs both have income phase-outs, but the most you can sock away is only $7,000 for individuals under 50 years old, anyway. However, for a 401(k), you and your spouse can both contribute $23,500, for a combined household maximum contribution of $47,000. That’s a BIG chunk of change that can make a real difference in your retirement.

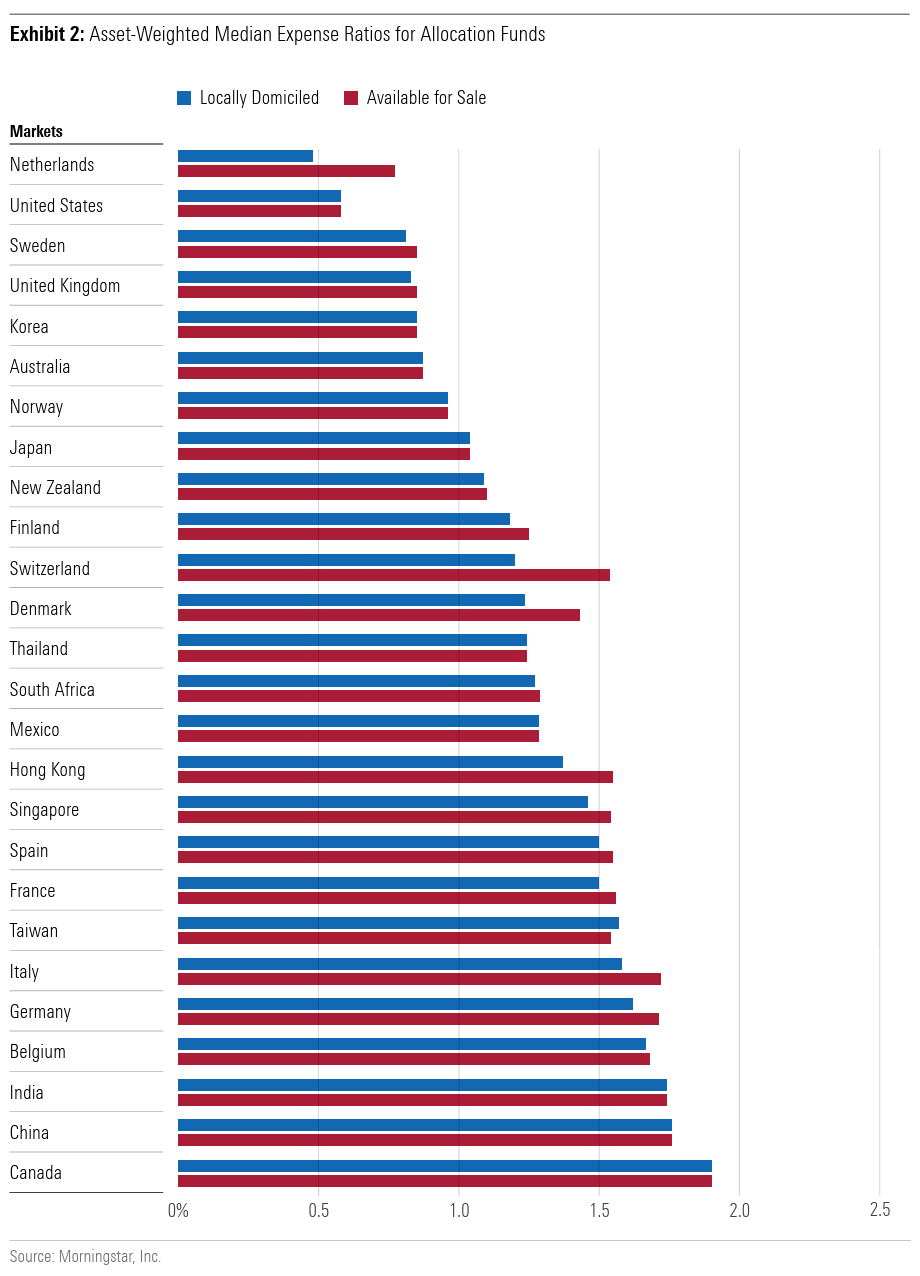

Broadly, investing in the U.S. – and especially inside 401(k) plans – is cheaper and more accessible than investment options outside the U.S.

As a U.S. resident, you have access to some of the cheapest, best-diversified options on the planet. Consider this 2022 study from Morningstar, which I would argue even undersells the passive ETF options available to U.S. investors by focusing on averages that include more expensive, actively-managed funds:

Reference: Morningstar Publishes Global Study of Fees and Expenses in the Fund Industry, Finds Fees Continue to Fall, Yet Room for Improvement in Industry Structure Remains. ©2022 Morningstar, Inc. “Fees and Expense Scorecard” chart.

Not only are U.S. investment options generally much cheaper than options abroad, but those options within 401(k) plans tend to be especially good. While fund menus are often limited compared to the wide investment universe of general investing / taxable brokerage accounts, those funds which are available are required by regulation to adhere to certain fiduciary standards. Your U.S. 401(k) can be a great place to build long-term wealth, relative to international options.

So how do American 401(k)s work after you move overseas, speaking generally?

If you do retire outside the U.S., you’ll still need to abide by U.S. tax rules for these accounts…

Will you still owe U.S. income taxes when you withdraw these funds? Yep. And what about Required Minimum Distributions (RMDs)? Yep, those will also apply, so long as you hold a U.S. 401(k) (or have rolled that balance into a Traditional IRA.)

… and there will be tax complexity depending on where you live when you pull out these funds

You may owe additional taxes on 401(k) withdrawals when you live in another country: some countries have a tax treaty with the United States that mitigates or simplifies these effects, while other countries have unique taxes that don’t have a direct U.S. counterpart. (For example, Spain has a wealth tax that applies to account balances even where you do not sell or realize gains.)

If you are taxed in two countries, the U.S. foreign tax credit can mitigate some of that bite, reducing your U.S. tax bill by some or all of the amount you’ve paid overseas. Note that such credits and complexities are very much subject to potential legislative change, both in the U.S. and in other countries.

You’ll also probably have some administrative fuss if you are outside the U.S.

Many 401(k)s – especially those sponsored by smaller employers – may struggle with non-U.S. addresses or not even provide an option for investors without a U.S. domicile. 401(k) plans also have some unique estate planning aspects – for example, it’s very difficult to disinherit a spouse from a 401(k), even if you wish the balance to pass to an adult child rather than a later-in-life second spouse – which may conflict with non-U.S. estate rules. Both of these can be simplified by maintaining a U.S. domicile or rolling over your 401(k) to a Traditional IRA before you move from the country.

Stepping Back

We’re talking about a tradeoff between a certain benefit (tax breaks today) against uncertain costs (the potential for greater taxes in retirement, if a second layer of country taxes apply.)

Perhaps you know for a fact that you’re only in the US for a limited time. In that case, you can operate with a decent degree of certainty, and you can act on country-specific information. You may want to do your own research if the dollars (or Euros, or Baht, or AUD) are smaller, or hire a specialist cross-border planning firm if your needs are more complex.

However, if your time horizon is longer than a decade, it may not make sense to walk away from real, immediate and certain benefits of an account like 401(k) to account for tax treatments and financial factors that could change dramatically between now and your retirement.

Suppose you will retire in 2050, 25 years from today. What if we look back at the financial events of the past 25 years, since 2000? 20 European countries consolidated their currency to the Euro – ciao to the Lira, and adieu to the Franc! Iceland was uniquely damaged in the Great Financial Crisis. In the UK, the Brexit vote was startling and surprising, whereas the increasing sophistication of investment options has been a slow burn as the country transitions from traditional pensions to 401(k)-style DIY retirement plans. Your plans could be affected by historic tragedy (e.g., Russia’s invasion of Ukraine) or mundane impossibilities (e.g., Spain’s 2025 announcement of a 100% tax on real estate owned by non-EU residents.) 25 years is such a long time horizon for macroeconomic factors.

Furthermore, you have no idea what the next 25 years will bring to your personal life. Your beloved spouse may become ill and require care only available in the United States. You may decide that an industrialized India bears little resemblance to your childhood memories of slower days. You could spend years fantasizing about financial independence in Thailand, only to ultimately be attracted to a new immigrant program in a different continent. Your daughter moves to a gorgeous Switzerland village with her husband and asks if you’d come help out with childcare for your adorable grandbaby. Your story can take you to so many places.

As the saying goes, “a bird in the hand is worth two in the bush.” The certainty of today’s tax benefits provides a healthy counterweight to the meaningful uncertainty of what the future holds for you and for geopolitics.

Other Considerations

Financial decisions can be very emotional. I sometimes hear those who dream of emigration resisting a 401(k) because it feels like a symbol of reducing their ties to a country that is not their home, with the added benefit of extra cash in their pockets today.

The degree to which I’d push back on a client with such feelings would depend on their tax circumstances today. If they are in a lower-income period where the pre-tax benefit of a 401(k) is less valuable to them, then this act of identity-affirmation comes at a lower cost. If they – combined with their spouse – are higher earners, I’d push back gently at the significant price of this symbolic act and try to understand whether other actions could achieve the same sense of peace.

Register for our next session of RightWise’s Webinar, “Difficult Financial Conversations with Aging Parents”.

Do you want pointers on how to have these conversations, and details on the specific documents you should ask about? Want to learn more about what you should discuss with your parents about their end-of-life plans – and how to frame those challenging questions?

In this session, our financial advisors cover:

Tactical strategies to bring up these important questions, even with the squirmiest and most avoidant of parents

An overview of the personal admin associated with loss of loved one

Key documents you want your parents to have on hand

All of our webinars feature BCG-alum slide decks, helpful PDF handouts and recordings sent to you via email after the session.

Could a financial advisor help you navigate the complexity?

Contributing to a 401(k) if you aren’t sure if you’ll retire in the U.S. is a complex decision with many tradeoffs: taxes, investment fees, compounding appreciation, near-term liquidity, currency effects, hopes fears and dreams, and more. A financial advisor can help you pick apart these dependencies so that you can make decisions based on numbers, not vibes.

Learn about having fewer questions and

more answers about your future

Discovery calls are a friendly, open start to a long conversation. Our financial advisor will introduce themselves, listen carefully to what matters to you, and help you understand next steps.