The “Investing” Side of Halal Investing

by Caitlyn Driehorst

Caitlyn Driehorst is a financial advisor at RightWise Wealth, as well as the firm's founder and CEO. Caitlyn began her career at the Boston Consulting Group and held strategy roles at MGM Resorts, Capital Group American Funds and two venture-backed wealth startups. She holds a B.A. from the University of Chicago and an M.B.A. from UC Berkeley's Haas School of Business.

Published: January 7, 2026

My parents’ Christian faith and their careful finances are inextricable. My parents – married since 1985 – proudly share that despite some lean years, they never missed a tithe (donating 10% of income to church and charity) and never carried a credit card balance (consumer debt is poor stewardship of God-given resources.)

So while I am not religious, I’m deeply aware of how soul-deep faith can touch one’s whole life. When a household with Halal investing objectives trusted my firm, I was genuinely honored.

And so, I spent days doing nothing but researching Halal investing: windows of tabs, pages of notes, and ultimately, a 20-slide deck of takeaways – and a series of custom portfolios built exclusively of Sharia-compliant funds.

In my research, I found a lot of ink online about Halal investing, but mostly from a religious perspective (makes sense!) rather than from the perspective of a professional investor.

I also felt the more actionable online writing was more focused on investing results, potential upside, and fund performance (“beating the index”) over sources and implications of risk.

Though I am humble on this topic, I felt a measured, investing-focused perspective may add to the online conversation. And so, without further ado:

Four ways that Halal principles will impact your portfolio:

Meaningful Concentration Risk: Even though Sharia principles suggest less risky investments at the company level, Halal funds are less diversified than mainstream counterparts, so you may see higher highs and lower lows – and if you work in tech, especially, you may be doubled on risk.

Quirky Real Estate and Fixed Income Workarounds: For mainstream investors, we mitigate equity risk with fixed income and real estate exposure. Sharia-compliant products exist for these asset classes, but there’s some nuance in risk levels.

Menu Driven by Boutique Managers: Expect higher fees and greater bid-ask spreads when you invest in boutique funds – but feel pride in supporting your community.

Importance of Tax Loss Harvesting: Many tax-protected accounts, such as 401(k)s and 529s, offer a limited fund menu with no Halal options. If most of your investing will be in taxable accounts, tax loss harvesting may be of especial value to you.

General principles of Sharia-compliant investing

Of course, the Muslim community is heterogenous and Halal investing particulars can be interpreted differently. However, across sources, the following principles stand out consistently as “don’t”s:

Interest-bearing bonds (“riba”) and companies that profit from them

Companies with high levels of debt

Stocks in industries or firms inconsistent with Islamic values (such as those selling pork or pornography, or organizations that profit from interest income)

Leveraging speculative tools such as derivatives and futures

As well as some “do”s:

Supporting the Muslim community

Cleansing impure portions of your investments (e.g., dividends) by donating these proceeds to worthy causes (“zakat”)

As with all values-based investing, however, you’ll see different boards interpreting these principles differently. How much debt is a “high” level of debt? Do chance-based elements in certain video games qualify as gambling? For a restaurant company, would its alcohol and pork sales be reasonably mitigated by a zakat approximation, or should that stock be disqualified from investment?

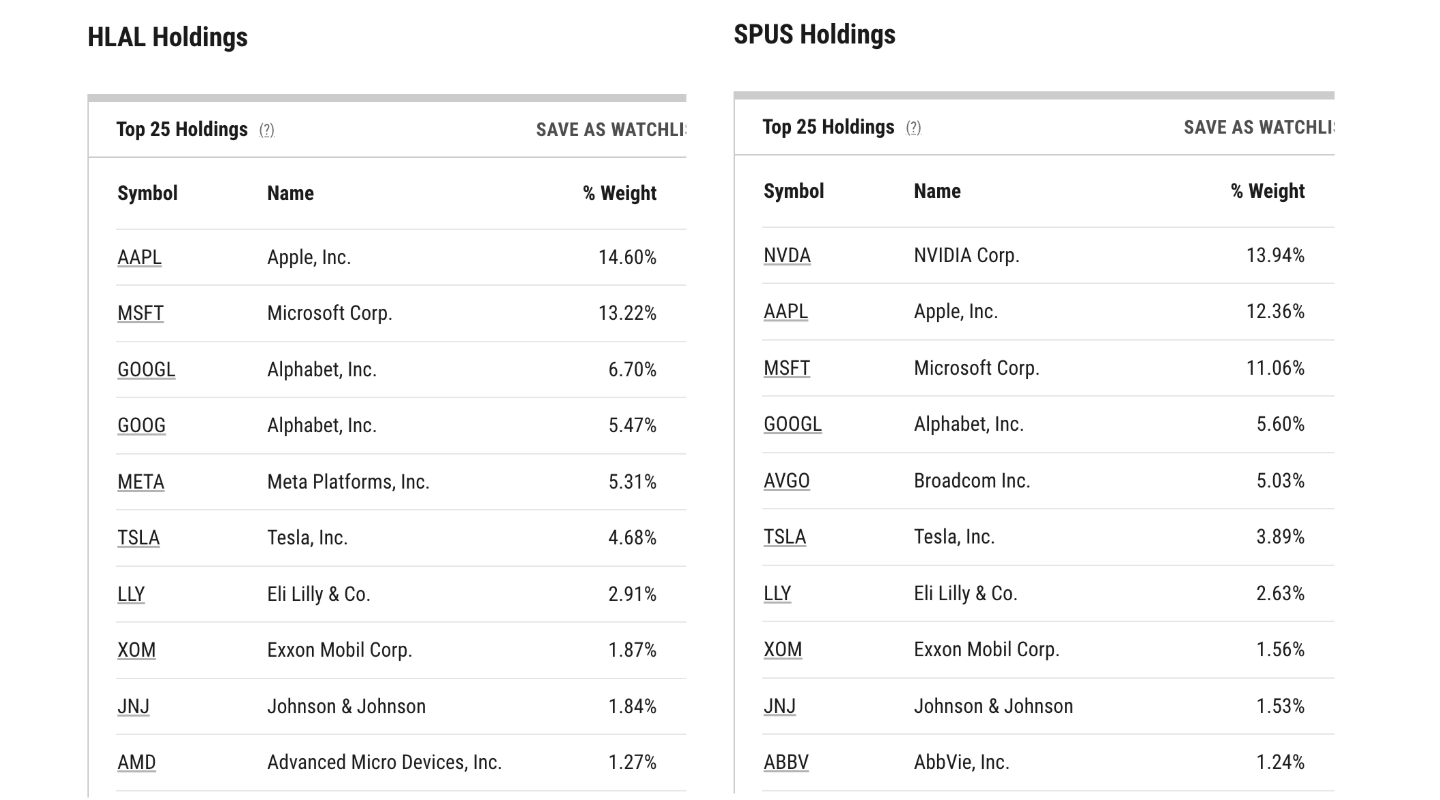

ETFs are transparent vehicles and it’s interesting to compare top holdings across Halal funds with similar investing objectives, in this case, SPUS (“SP Funds S&P 500 Sharia Industry Exclusions ETF”) and HLAL (“Wahed FTSE USA Shariah ETF.”)

Accessed January 3, 2026 via YCharts

Lots of overlap, as we’d anticipate: both hold meaningful positions in Apple, Microsoft, Tesla, Eli Lilly, Exxon Mobil, J&J. However, we see that SPUS excludes Meta (potentially for gaming or debt levels) whereas HLAL excludes NVIDIA.

Presumably, the religious auditors for these investment committees disagreed on these stocks: SPUS is audited by Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) whereas HLAL is audited by the Shariah Review Board.

Impact #1: Meaningful Concentration Risk

Even though Sharia principles would suggest less risky investments at the company level, Halal funds are less diversified than mainstream counterparts, so you can expect higher highs and lower lows – and if you work in tech, especially, you may be doubled on risk.

You read the list of “don’t”s: prohibitions against high levels of debt and against speculative investments would suggest that Halal investments would select lower-risk investments, all else equal.

However, industry exclusions mean that these funds are meaningfully less diversified than their mainstream counterparts:

Overweight large companies (underweight small / mid cap): Given challenges screening a greater number of smaller firms, the Halal stock funds I’ve looked at exclude or underweight small-cap and mid-cap firms, relative to mainstream indices

Overweight technology (underweight other industries): Given Halal criteria and business models characteristic to industries such as financial services, funds display industry bias

Overweight growth companies: Given preference for non-income producing assets and industry preference to technology, funds tend to be overweight growth companies

More concentrated than indices: Given screening criteria, funds are less concentrated than larger indices, e.g., holding ~200 positions rather than ~500 for US Large Cap

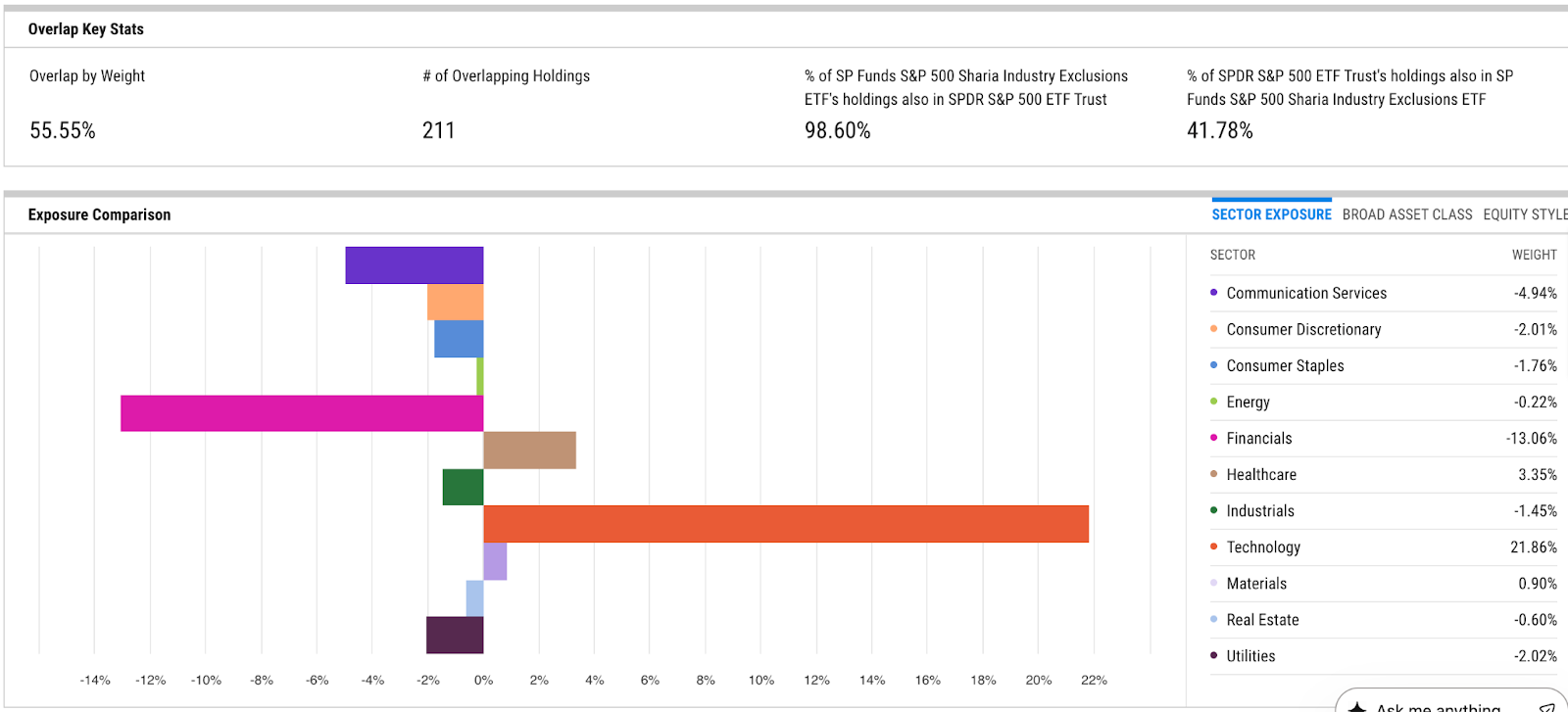

See for yourself: here is a comparison of the industry exposures of SPUS (SP Funds S&P 500 Sharia Industry Exclusions) and SPY (a proxy for the S&P 500, its mainstream benchmark)

Accessed January 3, 2026, via YCharts

Compared to the S&P 500, SPUS is 13% underweight the financial sector (likely because of interest income) while 22% overweight the technology sector.

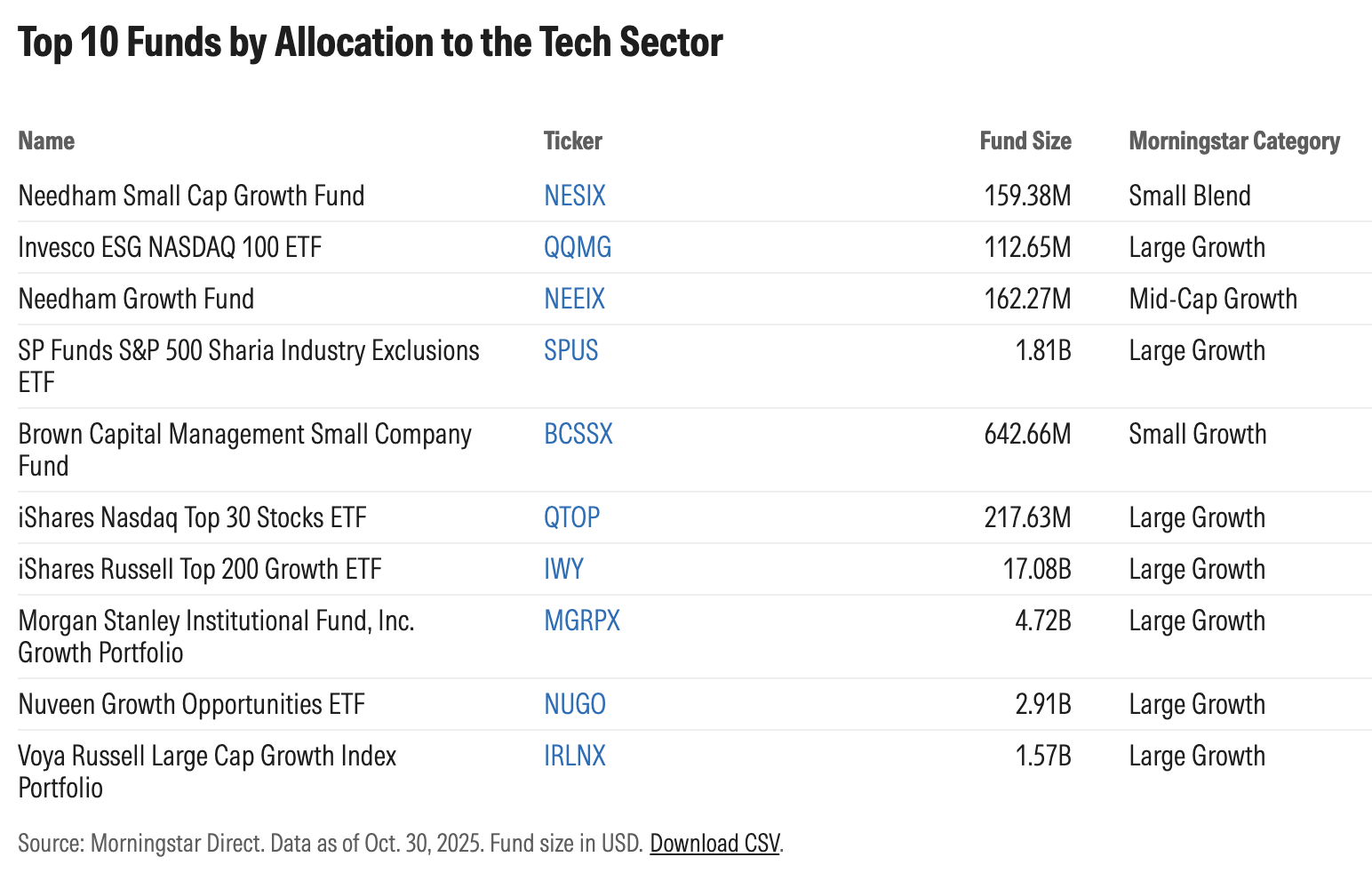

How extreme is this allocation? In October 2025, fund ratings company Morningstar rated SPUS as one of the ten funds with highest exposure to technology:

As the cliche goes, “diversification is the only free lunch in finance.” Diversification across industries means that your portfolio can hold its value as different factors affect different sectors: Russia invades Ukraine? There’s a global pandemic? The president implements a bunch of tariffs? Interest rates fall, interest rates rise? Tech will rise in one climate and fall in another; some headlines will lift energy and utility company prices, while other headlines will hammer those stocks. Spreading you bets reduces your overall risk.

That said, there’s another relevant cliche: “nothing ventured, nothing gained.” In general, we expect more concentrated, higher risk investments to have both higher potential for loss as well as higher potential for outperformance.

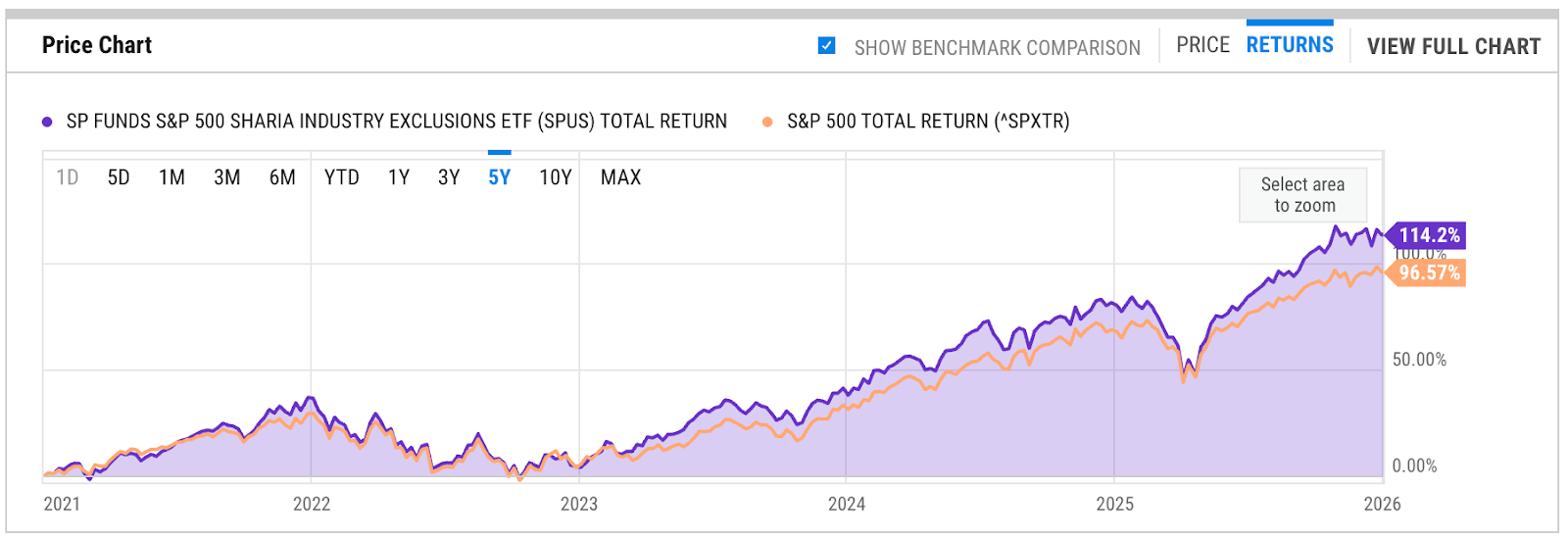

Since Halal funds are so heavily overweight technology – which has been on a tear, first coming out of the Pandemic and then more recently with the AI boom – we see Halal equity funds out-perform their mainstream indices over recent years. Compare the five-year total return of SPUS and SPY:

Accessed January 3, 2026, via YCharts

Hooray for extra money! But if headlines about an AI bubble trouble you, and you hold Sharia-compliant investments, then you should know that you have outsized exposure to this sector.

And if you work for a tech company, then you should also be aware of how this over-allocation increases the risk of your total financial life. Think of everything that already depends on your employer: your income, any employer stock you own or are vesting, potentially the value of your home if your employer is local, your ability to get another role within the industry.

We commonly advise clients to sell employer stock to diversify their risk; for clients for whom diversification would be Halal equity funds, your employer stock would represent extra risk since these funds are less diversified outside of your industry.

So what if you want to tamp down the risk? One option, obviously, is to hold more in cash so you would be less likely to need to sell investments at a loss during a downturn. However, where riba prohibitions would keep your cash out of high-yield savings accounts that could protect your purchasing power against inflation, that move has a cost.

You may want to consider also investing in other, non-equity asset classes to reduce your portfolio risk – and good news, you have some options! Specifically, some quirky options.

Impact #2: Quirky Real Estate and “Fixed Income” Workarounds

For mainstream investors, we mitigate equity risk with fixed income and real estate exposure. Sharia-compliant products exist for these asset classes, but there’s some nuance in the implementation.

REITs and Real Estate

Real estate exposure generally has the objective of diversification, current income and inflation protection. After all, you’d expect the value of Google’s stock and the value of an apartment complex outside of Dallas to behave differently over time – that’s diversification. We like to see clients invested in REITs either directly (by owning a fund) or indirectly (did you know there are around 30 REITs within the S&P 500?)

However, REITs aren’t consistent with Halal principles because of their high debt levels. Real estate investing is, after all, all about leverage.

SPRE is an interesting take on Sharia-compliant real estate investing: by holding equity stakes in real estate firms, the company avoids the debt conflict while still gaining exposure to real estate both in the U.S. and outside the U.S., and both residential and commercial holdings. Its fee – 0.50% – is higher than mainstream indices but not too far from benchmarks for focused real estate funds.

That said, this fund is quirky. For one thing, it’s small, with only $182M in assets. (Vanguard’s real estate fund, by contrast, holds $34.9B in assets.) While we look to real estate for diversification, this fund itself is concentrated: 49% of its assets are held in just four positions. I’d expect to see greater choppiness in performance where outcomes are driven by fewer underlying firms.

You should understand the quirkiness and what that means for you, but this is an interesting potential source of Islamic-friendly ballast for a larger portfolio.

Fixed Income Substitute, “Sukuk”

Bonds are, by definition, not compliant with Sharia prohibitions against interest, or riba. However, Sukuk are an innovative financial product pioneered initially in Malaysia in 2000; they are layered certificates representing a share in revenue associated with assets. This asset-backed nature avoids riba and facilitates financing for large projects, and nicely mitigates the interest rate risk we typically expect with bonds and fixed income. If you’re a financial product nerd, these are really fun.

SPSK is an ETF that tracks the Dow Jones Sukuk Total Return (exReinvestment) Index, also sponsored by S&P Funds. For a newer ETF, it’s done an excellent job aggregating assets, adding more than $100M in new assets in 2025 alone, suggesting pent-up demand for this type of investing. And where one of the tenants of Islamic investing is contributing to community, you can also feel warmly that an investment in this fund contributes to infrastructure and major construction projects in the Muslim world.

However, it’s worth noting that since Sukuk is an Islamic financial product, these investments naturally have a strong geographic concentration: more than half of the underlying certificates from this fund originate in either the UAE or Malaysia. Obviously, this introduces some geopolitical risk where fixed income is typically where we go to avoid risk.

Similar to SPRE, this is a quirky option, and the geographic concentration keeps it from being a slam dunk for mitigating total portfolio risk. But for diversification and a community benefit objective, a reasonable allocation is defensible.

Impact #3: Menu Driven by Boutique Managers

Expect higher fees and greater bid-ask spreads when you invest with emerging asset managers – but feel pride in supporting your community.

The world of Islamic finance is small: there are only 10 or so ETF options out there. A few are sponsored by larger asset managers, but in researching these for my client, I wasn’t as happy with their religious bona fides. Instead, I was drawn to two boutique issuers, SP Funds and Wahed:

SP Funds is a boutique, specialist ETF sponsor for Sharia-compliant investments, including five ETFs and a line of target-date funds. Its oldest fund originated in 2019 and as of January 2026, the firm manages around $2.8B in total. Headquartered in Florida.

Wahed operates a roboadvisor as well as a riba-free savings account, alongside three ETFs. While the company was founded in 2015, its first ETF was launched in 2019. As of January 2026, the firm manages around $952M across its funds. Headquartered in New York City.

For both of these fund families, I appreciated that they are specialist investors with copious information on their website, including certificates of Sharia accreditation and quarterly recommendations for Zakat payouts per share.

For both SP Funds and Wahed, their flagship equity funds are decently-sized: SPUS manages around $1.9B and Wahed’s HLAL manages $722M. However, both fund companies have more-recently launched funds that are smaller: SP Funds’ SPWO (an international fund) was launched in 2023 and manages “only” $102M, and Wahed’s KWIN (an income-oriented strategy) was launched in 2025 and manages $38M. (All figures as of January 2026.)

There are downsides when you invest with smaller ETFs: because there are fewer people trading these funds every day, the bid-ask spread can be wider, a “hidden expense” in trading these funds. Where fixed costs are amortized over a smaller asset base, fees are naturally higher in smaller funds.

For many reasons, being an emerging ETF issuer is an incredibly difficult business, especially for a niche product like Halal investing. I have friends who have launched ETFs, and there’s so much heart in it – and so, so many funds shut down.

But you know what makes life easier for an emerging manager? Becoming an established manager. When you invest with a Halal-focused boutique, not only are you receiving a specialist product, but you are also – dollar by dollar – making these investments more attractive for those who stand behind you in line. To the extent that benefitting the Muslim community is an objective of Islamic investing, this feels like poetry.

Impact #4: The Importance of Tax Loss Harvesting

Many tax-protected accounts, such as 401(k)s and 529s, offer a limited fund menu with no Halal options. If most of your investing will be in taxable accounts, tax loss harvesting may be of especial value to you.

So there’s only ~10 Halal ETFs out there – and maybe there’s a 401(k), 403(b) or 529 that offers these funds in their default lineup, but I haven’t heard of one. And while there are retirement plans that offer brokerage options with greater fund availability (especially at larger employers), 529s exclusively offer restricted investments.

If your convictions are such that you only feel comfortable investing in Sharia-compliant funds, then a lot more of your investing picture will be in taxable accounts than the average mainstream investor. While you’ll have greater liquidity, you’ll miss out on tax-free compounding and other pre-tax and post-tax benefits.

If you work in tech — and thus have RSUs taxed as income — and live in a high-tax state like New York or California, you may be in your life’s highest-tax years.

Plus, as a member of the Muslim community, you’ll have the indignity of paying relatively more than others in taxes to a U.S. government that (stating mildly) hasn’t always behaved politely towards your religion or its observants.

For these reasons, I’d strongly encourage high-earning, actively-saving investors with Islamic objectives to invest their taxable assets in portfolios that have enabled tax loss harvesting. (Of course, your individual circumstance could vary.)

What is tax loss harvesting? The Internet is full of excellent explanations; if you are unfamiliar, please open another tab, read an Investopedia or other article, and come back.

At RightWise, we’ve seen tax loss harvesting add real value to real clients, especially in the tariff volatility of April 2025. This was an academically-excellent opportunity to see tax loss harvesting in action because the crash was unusually deep, and both the immediate and extended recovery were steep.

Via tax loss harvesting during this time, one of our clients realized nearly $30,000 of short term losses, while staying invested through the volatility and ultimately ending the year nearly $150,000 ahead of their January 1st, 2025 balance. (Note: this was not a Halal investing client, but similar dynamics could play out across taxable accounts with different underlying portfolios.)

If our client had just bought and held the same funds on a self-directed platform without tax loss harvesting, they (probably) would have still ended the year $150,000 up – but that entire gain would be taxable. Instead, with tax loss harvesting, this client can use losses to offset income or other gains, while ending up with the same long-term growth in their account.

These numbers are provided as an educational illustration of the tax loss harvesting mechanism. We’re not promising that your results would be similar to those of the client in this illustration; every year has different investing dynamics. All investing includes the risk of loss.

So what is the value of $30,000 of realized short term losses?

Hypothetical: Suppose you had $30,000 of short-term losses, all incurred while still growing the top-line value of your portfolio. What could that do for you?

Offsetting $3,000 of ordinary income, assuming 35% tax rate:

($3,000) * (35%) = $1,050 of avoided taxes

Offsetting $30,000 of short-term capital gains, assuming 35% tax rate:

($30,000) * (35%) = $10,050 of avoided taxes

Offsetting $30,000 of long-term capital gains, assuming 20% tax rate:

($30,000) * (20%)= $6,000 of avoided taxes

Fantastic savings — and all while preserving their money’s potential for growth in the market! Gains on paper, losses captured and placed in your pocket. (Note that in this simplified example, the long-term capital gains tax rates would be even higher if this hypothetical household were in California, which taxes capital gains at income rates.)

Tax loss harvesting is tricky business: trades need to be executed quickly so that you can stay invested through recoveries, and it’s critical to account for wash sales that can disqualify tax losses. And if you are only trading a limited number of funds – such as the limited world of Halal funds – you’ll want to be careful of activity across accounts, including your 401(k), as this can also generate wash sales.

I’m proud that we have built our own RightWise portfolio for Halal investing, with tax loss harvesting enabled across equity allocations. We can segment your taxable brokerage across multiple financial goals – children’s education, retirement, general wealth building – and enable tax loss harvesting with immaculate tracking for wash sales and other complexities. I’d love to tell you about our ability to implement these investing strategies; reach out if you’d like to chat with me and learn more.

As you can tell, I’m passionate about this topic, and I’d love to write future posts: why we love DAFs for Zakat (especially if you have stock compensation from your employer) and how we think about UTMAs vs taxable brokerage if you’re investing for your child’s education or future otherwise.

If you’d like to work with a firm that cares this deeply about their clients and their personal values, please reach out. We’d love to talk with you.