Front-Load Your 529, Part Two: The “How”

by Caitlyn Driehorst

Caitlyn Driehorst is a financial advisor at RightWise Wealth, as well as the firm's founder and CEO. Caitlyn began her career at the Boston Consulting Group and held strategy roles at MGM Resorts, Capital Group American Funds and two venture-backed wealth startups. She holds a B.A. from the University of Chicago and an M.B.A. from UC Berkeley's Haas School of Business.

Published: January 6, 2026

Many thanks to those who have reached out with praise and appreciation for our prior blog post, “Why You Should Front-Load Your 529 Plan.” This has become our most popular blog post with twice the clicks of prior posts, and I’ve heard it’s gone viral on at least two company Slack channels for personal finance.

Apologies to the fans! This person is not a client and was not compensated for these kind comments about Hannah.

By popular demand, here is our follow-up post, the “how” for this maneuver.

Interestingly, this question of “how can you invest big into a 529?” isn’t constrained by the 529 itself. Out of the fifty different states’ 529s available (every state except Wyoming, plus DC, has their own 529 plan, and many states have multiple plans) no state has an annual maximum contribution, and lifetime maximum contributions range from $269,000 (Wisconsin) to $621,411 (New Hampshire.) (Source.)

Instead, the complexity for front-loading 529s comes from “gift tax,” one of the most oddly-named little quirks of becoming a well-off adult. In this post, we’ll cover what is gift tax, why you probably shouldn’t be worried but should pay attention, and how you can load up your 529 while keeping the paperwork straight.

Note that while this article includes general education about taxes, we are not CPAs and do not provide tax advice (though we do have an optional, integrated tax partnership for clients); similarly, while we talk about estate matters, we are not lawyers and do not provide legal advice.

What Is Gift Tax?

I like to point out to clients how often you can figure out finance terms by listening to the names. An “exchange-traded fund” is a fund that’s traded on an exchange. “Fixed income” securities pay out fixed amounts as income.

That said, “gift tax” totally breaks my rule. The name makes no sense.

“Gift tax” is NOT money you owe the government for Christmas. Instead, it’s more related to estate taxes. You may have read that if you die and your taxable estate is above a certain number (in 2026, that’s $15.0M for an individual, and $30.0M for a married couple) then you’ll owe a cut of your estate in federal taxes after your death. (Some states have lower limits or other, related taxes.)

Those limits – $15.0M for an individual and $30.0M for a married couple – are actually not only the limits above which you owe federal estate taxes at death. They represent the “unified credit exemption,” which is the total amount that you can give away as inheritances at death OR as gifts during your life. Both of these – inheritances and gifts – count against that same budget of “don’t tax me” money.

Why does this system exist? Imagine that you are a rich person and you don’t want to pay estate tax. “I know what I’ll do,” you think to yourself. “I’ll just give my money to my kids while I’m living! $1,000,000 to Bunny, $2,500,000 to Pinkie, et cetera et cetera, and I’ll get my estate below that tax threshold."

With my apologies to Bunny and Pinkie, the government got there first. The government says, “Mmm, not so fast. If you give someone more than a certain amount,” (it’s $19,000 per individual per year in 2026), “then you are required to tell us about that gift, and we’ll keep a tally your whole life long, and when you die, we’ll count those gifts against this allowance of what you as one person can give away without it becoming our business.”

“Gift tax,” then, is not actually a tax, but rather, a “heads up” letter you file to the government that tells them you’ve made one of these big gifts (Form 709), and it only comes up again if you die with so much money, you’re in the ballpark for owing estate tax.

And to be clear, if anyone ever does owe gift tax, it would be the giver who owes (never the recipient) and it would be paid from their estate after their death (nothing owed today)

Some situations where gift tax never applies:

Gifts between spouses: “For richer and for poorer,” indeed. Gifts and cash transfers between spouses don’t count as taxable gifts. Your financial identity is merged.

Tuition or medical expenses on someone’s behalf: These exemptions don’t count as gifts, so long as you pay the school or medical center directly rather that giving cash to the individual.

Quotidian parenting costs: Food, housing, trips to the zoo – the day-to-day care of your dependent child is considered fulfilling a legal obligation (woo) and is not a gift.

Some situations where gift tax would apply, assuming the total amount is above the threshold where reporting is required:

“Helping out” with the down payment on a home for your child

Purchasing a car for your adult child

Paying rent for your adult child while they are in grad school

(Want to read a juicy article about how wealthy families make big gifts to their children, with techniques ranging from sneaky loopholes to straight-up rule-breaking? Read this article in New York Magazine.)

Should You Even Care About Estate Taxes? Maybe, Maybe Not.

Today, the estate tax threshold is very high, and the “One Big Beautiful Bill” Act both raised that limit and indexed it against inflation to continue increasing each year. Even if you are very successful, your personal wealth may not achieve such lofty numbers by the end of your life.

Some reasons you may care about avoiding gift tax notifications, even if you don’t see a path to eight-figures of net worth in your lifetime:

The government may change its mind: Liberal leaders have called for more Americans to owe estate tax as a tool to address the wealth gap, and if our national debt levels continue to increase, the government could lower these limits to increase revenue.

Lower state limits may apply: Maybe you don’t have a path to $30.0M and beyond, but some states have lower limits for estate taxes or inheritance taxes, such that even the sale of a primary residence can pull these taxes into consideration. In Oregon, for example, the exemption is “only” $1.0M, and that could sneak up on even a middle-income family if their home has meaningfully appreciated. (Source)

“Paperwork” sits outside your zone of genius: First, if you truly hate paperwork, please consider hiring a good CPA – or a financial advisor with integrated tax filing, such as RightWise Wealth! But if your 30s have gifted you with self-knowledge and acceptance and you know you suck at paperwork, you may want to avoid needing to file paperwork and setting yourself up to fall afoul of infractions.

You Can Make BIG Contributions Below Gift Tax Limits

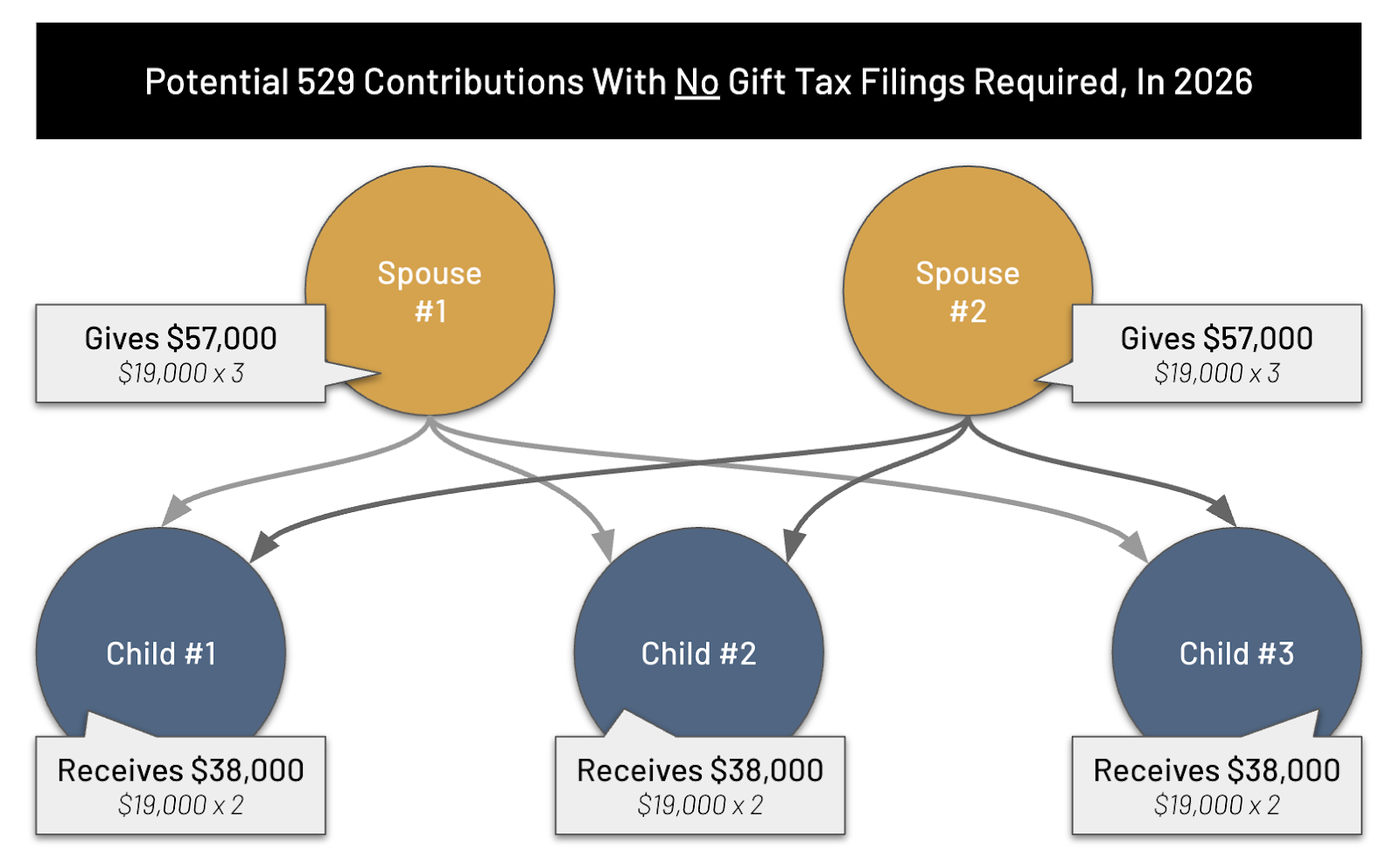

In 2026, the gift tax maximum is $19,000 per individual giver, per individual recipient. You and your child’s other parent can thus contribute up to $38,000 per year to each of your children without having to fuss with Form 709. That would still be a big gift, more than many people contribute – and it wouldn’t require any gift tax paperwork or extra brain cells.

Illustration for how two parents could make maximum gifts to three children, and none of these $19,000 gifts would require gift tax filing

“There is some nuance here, if you want to make these bigger gifts but avoid adding to your paperwork pile,” notes Jason Safa, EA, who works with RightWise clients for tax advice and tax filing via our integrated partnership with Uprise. “Each spouse can individually contribute up to $19,000 to a 529 and not need to file Form 709, but if two spouses are splitting a gift greater than $19,000 (say, if the gift comes from their joint checking account) then you will need to file Form 709, even if the total sum is less than $38,000 – the annual exemption for two individuals. Even for me, this box-checking isn’t intuitive and I keep a firm grip on the wheel when navigating these waters for clients; if you’re working on your own, it can’t hurt to double-check your strategies here with a tax professional or financial advisor.”

Jason Safa, EA, is one of the tax partners at Uprise who works hand-in-hand with RightWise financial advisors’ clients who opt into this optional add-on service

If you’re going to fund your child’s 529 with less than $19,000 as an individual or $38,000 as a couple, in 2026, you can skip the rest of this blog post. If you have read our first blog post and you want to give more, read on.

So How Can You Front-Load Fund a 529? Two Paths

Option A: Just File the Paperwork

Let’s not overhype walking through the front door, socking in the cash that you desire to give, and filing the Form 709 paperwork to log the gift with the IRS. It’s one additional form, prepared by your CPA or by your tax software; it incurs zero direct costs today; and if you die with a net worth less than the tax exclusion, there are no implications.

“We e-file these, same as 1040s,” says Jason Safa, EA. “Clients can fill this out on their own if they’re paper-filing their taxes, but it’s not what I would recommend, given complexity.”

For the reasons listed above, you may want to avoid triggering this requirement, but let’s dimensionalize the situation – it’s truly not the worst.

Option B: Elect Superfunding on Form 709 to Accelerate Five Years’ Gifts With No Gift Tax

You can “pull forward” up to five years’ gift allowance at once with one gift, and – on your gift tax form, Form 709 – check the box on Schedule A, Part 1, to indicate that you want this single year’s gift to count towards five years’ contribution, forswearing any future gifts during that future timeframe. You’ll also need to attach a statement indicating the beneficiary, the amount contributed, and how you’d like to see those gifts prorated across years. This contribution will then not count towards your lifetime gift allowance, provided you stay in compliance; you won’t need to re-file this form over multiple years.

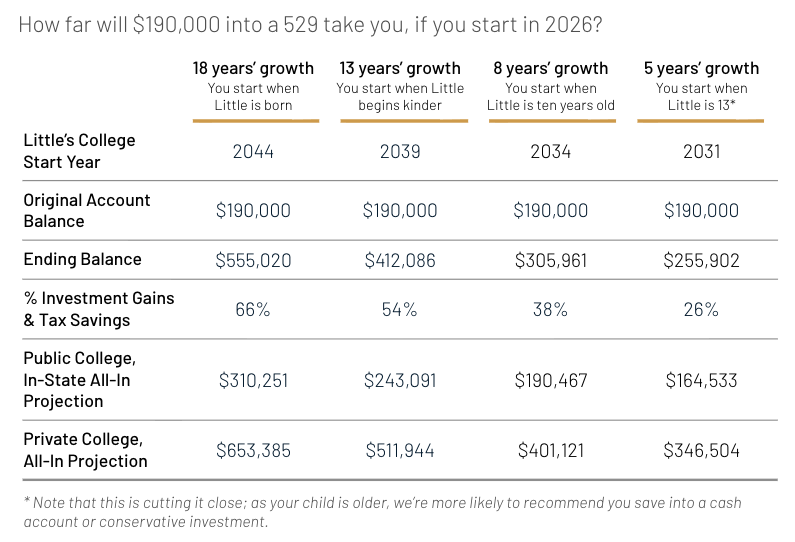

The max you can superfund a 529 with this mechanism? $95,000 per parent, or $190,000 for a couple. (That’s $19,000 per year, for five years, per individual.)

How far could $190,000 into a 529 take you? Even though the market has better years and worse years – and investing always includes the risk of loss! – for this simple exercise, let’s assume you get 6% every year, compounding quarterly:

I arrive to the same destination as in the first part of this blog post: this is why they say it’s cheaper to be rich than to be poor.

How does front-loading interact with state income tax annual benefits?

You may live in a state that offers an annual income tax deduction or other benefit if you contribute to that state’s plan.

These benefits vary: California – consistent with its reputation – offers no state income tax benefit, and neither does Nevada (in our defense, there’s no state income tax against which you need a deduction!) At the other extreme, Colorado’s plan offers its residents up to $39,200 per household return as a deduction against state income taxes for 529 contributions.

Lump-summing your 529 benefit may – or may not! – have implications for your ability to take future deductions for state plans. Some states will let you carry forward contributions in excess of annual deduction maximums: Washington, DC, limits couples to $8,000 per year of deduction, but allows past deductions to “carry forward” up to five years against future returns.

Other states may not offer this benefit, and the detail of state website FAQs varies. To confirm, you’ll want to dig up the “Summary Plan Description” regulatory disclosure document – or hire a financial advisor and ask them to do that work for you.

There’s a lot of “If You Give a Mouse a Cookie” in financial planning and investing. Making one decision, like front-loading a 529, can trigger a cascade of follow-up decisions:

Can you afford to frontload a 529, and stay on track for your retirement? What if you and your spouse have a big age gap but you want to stop working the same year, could you still afford this strategy? What if having this kiddo means you also need a larger home or to move to a better district – can you have it all?

What funds should you choose within the 529? Which state’s plan should you choose? How should you think about in-state tax benefits?

Is your CPA responsive to emails about these tricky tax moves? Do you feel confident they’ll keep track of the details on your return?

At RightWise, we can take all of these off of your plate – not only for your 529, but for your whole complex financial picture:

Concierge management of your tax return, working hand-in-hand with our tax partners at Uprise (including Jason!) so the mental load sits with us, not you

Financial projections for retirement and everything in between, so you can make major life decisions with numbers, not vibes

Pinpointing how much you’ll need to front-load a 529 based on your goals. Full funding for private school? Just for in-state? Assuming Kiddo may benefit from a little student debt? How do these numbers vary for Older Kid vs Younger Kid?

Educating you on the end-of-life documents and structures that can protect your family; we now include basic versions of these documents in our financial planning fee. We’re very good at turning “ugh, I know I need to do that” into checked boxes.

You don’t have to spend your weekend doing homework to solve solved problems. Reach out today for a friendly chat to see if our firm could be a good fit.